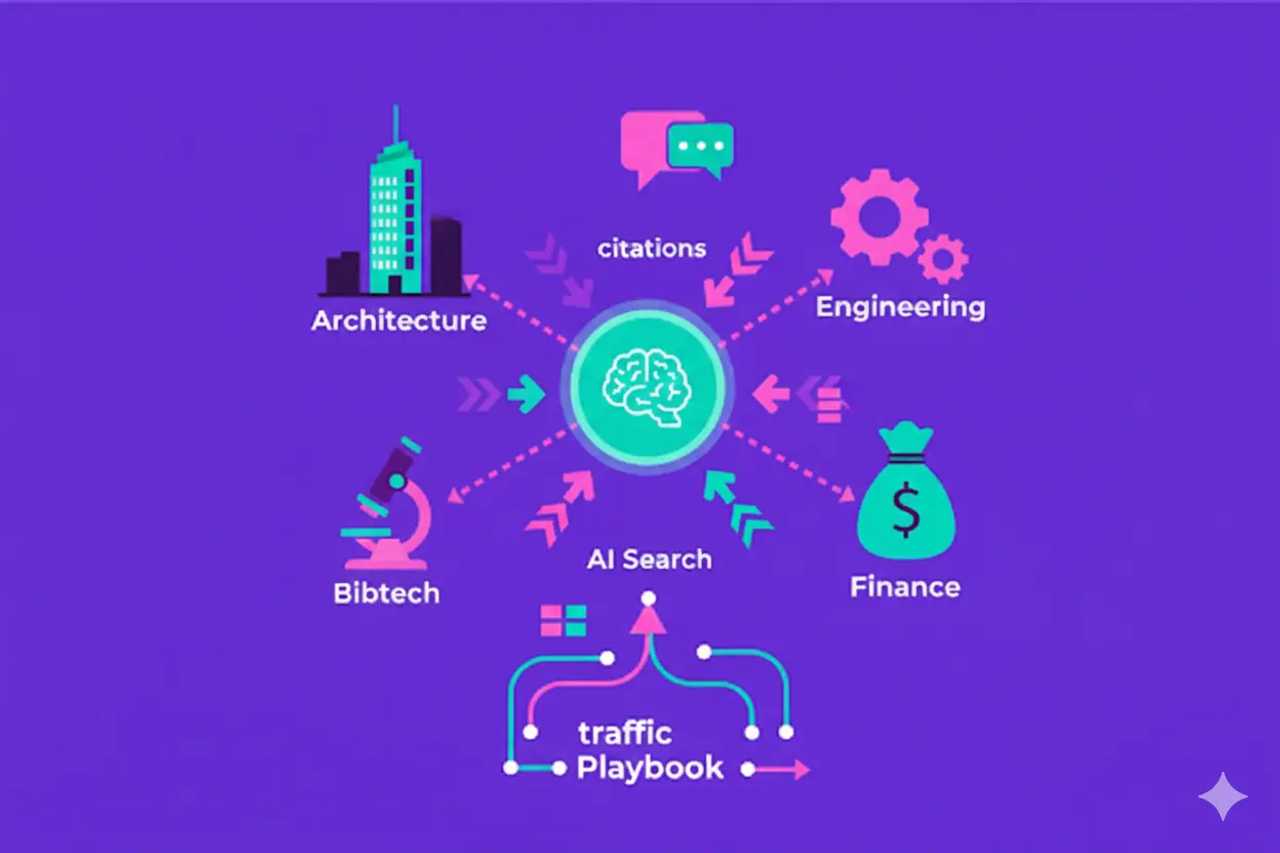

AI citations do not spread evenly.

Health answers lean on government and hospital sites, retail answers lean on brands and marketplaces, and B2B answers lean on product-led guides and analyst sites.

If you know the patterns in your industry, you can build assets that assistants already prefer and reclaim citations from competitors.

This guide synthesizes public research, distills industry archetypes, and gives you playbooks, schemas, and KPIs tailored to each vertical.

You also get a 30 day plan to baseline your industry and ship fixes that move citation share.

Use it to focus your AISO work where it will pay off fastest.

What the current data shows

Multiple reports point to similar themes:

Brand-managed properties drive most citations in many industries. Yext reports 86 percent across four sectors.

Aggregators dominate certain industries: marketplaces in retail, directories in local services, and community forums in tech.

AI answers often cite non-ranking pages if those pages offer clearer facts or entities. SERP rank is not the only factor.

Citation diversity varies. Health and finance skew toward .gov and .edu sources, while retail and travel skew toward brand and marketplace mixes.

English dominates many datasets. Non-English markets remain under-reported, leaving opportunity for regional brands.

Use these themes as a starting point, then measure your own prompts to confirm local patterns.

Industry archetypes and citation patterns

High-stakes YMYL (health, finance, legal)

Who wins: .gov, .edu, hospitals, regulators, and select high-trust publishers.

Brands with strong EEAT and reviewer credentials can earn citations for informational queries, while product pages rarely appear.

What assistants cite: definitions, risks, eligibility criteria, dosage or rate tables, and policy documents.

Implications: you need verified experts, reviewer schema, clear disclaimers, and links to authoritative sources.

Thin sales pages will not be cited.

Product-heavy retail and ecommerce

Who wins: brand sites, marketplaces, and review publishers.

Category and buying guides often outrank individual PDPs for citations.

What assistants cite: comparison tables, specs, care instructions, returns, and shipping details.

User reviews and Q&A often influence summaries.

Implications: build AI-ready buying guides, robust PDPs with Product and Offer schema, and comparisons that map to real intent.

Align with the product playbook from Product Pages AI Citations: Playbook for AI Search Teams to tighten templates.

Service and local

Who wins: trusted directories, local media, and brands with consistent NAP and LocalBusiness schema.

Government or chamber sites often appear for regulated services.

What assistants cite: service descriptions, pricing ranges, hours, reviews, and safety or licensing notes.

Implications: invest in LocalBusiness schema, city-specific pages, and local proof.

Link to your citation pillar AI Assistant Citations: The Complete Expert Guide when you explain processes to reinforce authority.

B2B SaaS and tech

Who wins: vendor product pages, docs, and comparison guides, analyst and review platforms, and technical blogs with strong entities.

What assistants cite: integration steps, feature comparisons, pricing ranges, security and compliance claims, and ROI proof.

Implications: add Product and Organization schema, security and compliance pages, and integration FAQs.

Tie measurement sections to AI SEO Analytics: Actionable KPIs, Dashboards and ROI to show depth.

Content-driven education and media

Who wins: universities, large publishers, and niche experts with topic authority.

Forums and community sources appear for specialized topics.

What assistants cite: definitions, how-tos, timelines, and evidence-based summaries.

Implications: build clean Article and FAQ schema, author bios with credentials, and consistent internal links.

Original research and transparent sources lift citations.

Industry levers: what moves citations by sector

Health and finance: reviewer schema, clear citations, dated updates, and conservative claims reduce risk and win trust.

Retail: complete Product/Offer schema, up-to-date availability, comparison tables, and UGC snippets drive inclusion.

Local services: NAP consistency, LocalBusiness schema, reviews, and neighborhood-specific FAQs support local prompts.

B2B SaaS: integration guides, security proof, and pricing clarity paired with Product schema help assistants select your pages.

Education/media: author expertise, citations to primary sources, and FAQ or HowTo schema make content reusable in answers.

Match your investments to the levers that matter most for your vertical.

30 day industry baseline plan

Week 1: Scope and prompt design

Map your industry archetype and sub-verticals. Include regional focus if relevant (e.g., PT-PT).

Build a prompt set: discovery, comparison, objection, and local prompts. Include the high intent prompts from the brief, such as “How do I earn accurate ai citations by industry.”

Tag prompts by category, intent, risk level, and geography.

Week 2: Baseline run

Test across Google AI Overviews, Bing Copilot, Perplexity, Gemini, and ChatGPT browsing. Capture screenshots and text.

Log citations: domain, page type, position, sentiment, and accuracy. Note YMYL risk.

Score inclusion, First Position Share, and Brand Risk. Segment by industry archetype.

Week 3: Diagnose gaps

Identify which asset types win in your vertical (guides, PDPs, docs, reviews).

Compare your assets to winners. Note missing schema, weak entities, or thin proof.

Map quick wins: schema fixes, page refreshes, internal links to pillars, and evidence blocks.

Week 4: Ship fixes and remeasure

Update top pages per archetype with schema, proof, and concise answers.

Add or refresh author and reviewer info where needed.

Strengthen internal links to relevant pillars, including citation and analytics content.

Rerun prompts. Record changes in inclusion and position. Share results with stakeholders.

Make this monthly.

Add new prompts each quarter as products, regulations, or seasons change.

Playbooks by archetype

YMYL health/finance/legal

Use reviewer schema with credentials and jurisdictions. Keep last reviewed dates visible.

Add citations to primary sources (guidelines, regulations) near key claims.

Publish risk and safety notes. Avoid definitive language where evidence is limited.

Maintain LocalBusiness schema for clinics or offices. Include service areas and licensing details.

Monitor daily for harmful answers and escalate within 24 hours.

Retail and ecommerce

Implement Product, Offer, Review, and ProductModel schema with GTIN/SKU and availability.

Build buying guides and comparisons that link directly to PDPs.

Use concise FAQs for sizing, compatibility, shipping, and returns.

Add media with transcripts and alt text. Include UGC snippets that highlight real use cases.

Track price accuracy and variant correctness in AI answers weekly.

Service and local

Keep NAP consistent across site and directories. Use LocalBusiness schema with opening hours and service areas.

Publish city or neighborhood pages with specific FAQs and proof.

Collect and surface reviews from trusted platforms. Link to them.

Add staff bios and credentials for trust-heavy services.

Monitor local prompts in Portuguese and English if you operate in Lisbon.

B2B SaaS and tech

Treat product pages as solution pages: use cases, integrations, security, and ROI.

Use Product and Organization schema, and add FAQPage for procurement and security questions.

Link to implementation guides, case studies, and analytics pillars to show depth.

Include pricing clarity or ranges to avoid wrong assumptions.

Track citations for integration and comparison prompts. Refresh quarterly as features ship.

Education and media

Publish original research or data-backed summaries with transparent sources.

Use Article and FAQPage schema linked to real authors with credentials.

Keep update dates and change logs visible.

Build topic clusters with clear internal links and breadcrumbs.

Avoid clickbait titles. Assistants favor clarity and authority.

Schema and entity priorities by industry

YMYL: Article, Person, Organization, FAQPage, Review, and when applicable LocalBusiness. Add reviewer and citation details.

Retail: Product, Offer, Review, AggregateRating, ProductModel, and BreadcrumbList. Tie to Organization.

Local: LocalBusiness, Organization, FAQPage, and schema for specific services where available.

B2B SaaS: Product, Organization, FAQPage, HowTo for implementation, and Article for deep dives. Link to security and compliance pages.

Education/media: Article, Person, Organization, FAQPage, and HowTo when teaching steps. Keep sameAs links current.

Align schema with on-page copy.

Assistants penalize hidden or misleading markup.

Metrics and dashboards by industry

Inclusion rate by industry archetype and engine.

First Position Share by prompt type (discovery, comparison, objection).

Citation Accuracy Index segmented by risk and archetype.

Asset type performance: guides, PDPs, docs, category pages, and FAQ pages.

Source diversity: count domains cited alongside you. Watch for over-concentration on a few platforms.

Revenue and pipeline influence by archetype. Tie gains to changes in schema and content.

Dashboards should show trends and annotations.

Use the models in AI SEO Analytics: Actionable KPIs, Dashboards and ROI to keep finance on board.

Build your own industry dataset

You do not need vendor-scale crawling to see patterns.

Start small and repeat weekly.

Select 50–100 prompts per archetype. Mix discovery, comparison, objection, local, and troubleshooting prompts.

Test across Google AI Overviews, Bing Copilot, Perplexity, Gemini, and ChatGPT browsing. Respect platform rules and use manual checks where automation is restricted.

Capture citations, context, and screenshots. Log prompt, engine, domain, page type, position, accuracy, sentiment, and date.

Tag domains as brand, marketplace, media, government, community, or directory. This shows who dominates each sector.

Trend over time. Look for volatility that signals model updates or competitor moves.

Compare to organic rankings. Note where AI answers cite sources outside the top three. These are openings for your content.

Even a month of data will reveal where to focus content, schema, and PR.

Internal linking and cluster strategy by industry

YMYL: link supporting research and policy pages to main guides. Keep evidence and reviewer trails clear.

Retail: connect buying guides, comparisons, and PDPs with consistent anchor text. Use breadcrumbs to reinforce hierarchy.

Local: link city and neighborhood pages to services and LocalBusiness hubs. Add FAQ links for common local questions.

B2B SaaS: link product pages to docs, integration guides, and security pages. Connect analytics content to product value.

Education/media: build topic clusters with pillar guides, glossaries, and how-tos. Use breadcrumbs and related content modules.

Strong internal links help assistants follow your entity graph and pick the right page for each prompt.

Content and schema quick wins per archetype

YMYL: place reviewer details and citations within the first 150 words. Keep Article and Person schema aligned.

Retail: add concise comparison tables and FAQPage schema to category and buying guides. Sync Offer data daily.

Local: keep address, hours, and service areas visible and marked up. Add photos with alt text to show real locations.

B2B SaaS: add integration FAQs and security summaries with links to deeper docs. Use Product schema and FAQPage on solution pages.

Education/media: include source links near key claims. Add FAQPage for common questions and keep update dates prominent.

These moves often shift inclusion and accuracy within one or two testing cycles.

Multilingual and regional nuances

Test prompts in Portuguese and English if you target Portugal. Many assistants mix sources by language.

Keep hreflang and inLanguage aligned. Ensure schema matches the language of each page.

Cite local authorities and media where relevant. Regional sources increase trust and representation.

Track when assistants default to US sources. Use this to justify more local content and PR.

For regulated industries, include local legal references and disclaimers in each language.

Regional consistency prevents misquotes and opens up less competitive citation spaces.

Experiment backlog by archetype

Add reviewer schema to top YMYL pages and measure citation accuracy changes.

Introduce comparison tables to high-intent retail guides and track inclusion shifts.

Move LocalBusiness schema and NAP to the top of local service pages and monitor local prompts.

Add integration FAQs to B2B SaaS product pages and watch comparison prompt citations.

Publish a research summary with transparent sources in education/media and track citations in Perplexity.

Localize top prompts and pages for PT-PT and measure changes in regional citation share.

Secure two authoritative external mentions per archetype and see if assistants shift toward your domain.

Score experiments by impact, confidence, and effort.

Run one per archetype per month and log outcomes.

Governance and risk controls

Assign owners by archetype: content, schema, analytics, PR, and legal/compliance where needed.

Set SLAs for harmful or inaccurate citations, with faster response for YMYL.

Keep change logs for pages, schema, and feeds. Annotate dashboards when releases go live.

Validate schema in CI and run spot checks weekly on priority pages.

Maintain a remediation register with incidents, actions, and results. Use it to improve playbooks.

Governance keeps improvements stable as you scale across industries and geographies.

Case style snapshots

Case A: A healthcare network lacked citations in symptom and treatment prompts.

We added reviewer schema, refreshed sources, and linked to national guidelines.

Google AI Overviews inclusion rose from 11 percent to 34 percent in five weeks.

Harmful claims dropped to zero.

Case B: A fashion retailer’s PDPs were ignored while marketplaces dominated.

We added ProductModel and Offer schema, built buying guides with comparison tables, and synced feeds daily.

Bing Copilot citations for top prompts climbed from 7 percent to 26 percent.

Revenue from cited products rose 10 percent.

Case C: A B2B SaaS saw Perplexity cite analyst sites over its own.

We added integration FAQs, Product and Organization schema, and security proof blocks.

We linked measurement sections to AI SEO Analytics: Actionable KPIs, Dashboards and ROI.

Lead citation share increased from 9 percent to 29 percent, and influenced pipeline grew 12 percent.

Case D: A Lisbon clinic saw directories outrank its site in local prompts.

We tightened NAP, added LocalBusiness schema, and published neighborhood-specific FAQs.

Copilot citations appeared in 8 of 12 tested local prompts, and calls from AI exposed queries increased 17 percent.

Use these snapshots to motivate stakeholders and justify industry-specific investments.

Pre-publish checklist for industry-fit pages

Intro answers the core intent in two sentences with a clear proof point.

Schema matches page type and is valid. SameAs links are present.

Sources cited on-page and, where relevant, reviewer or author credentials shown.

Internal links connect to relevant pillars, including AI Assistant Citations: The Complete Expert Guide and AI SEO Analytics: Actionable KPIs, Dashboards and ROI.

Local signals present where needed: NAP, service areas, and language alignment.

Update date and change log visible for YMYL or fast-changing topics.

Media have alt text and transcripts if included.

Ship pages only when every box is checked for your archetype.

How AISO Hub can help

AISO Audit: we baseline citation performance by industry, map gaps, and deliver prioritized fixes.

AISO Foundation: we build industry-fit content, schema, and internal link structures that assistants trust.

AISO Optimize: we run experiments on templates, prompts, and PR to lift citation share where it matters most.

AISO Monitor: we track citations by industry and engine, surface risks, and keep dashboards aligned with revenue goals.

We stay vendor neutral and tailor playbooks to your vertical, language, and markets.

Conclusion

AI citations follow industry patterns.

When you understand who wins in your vertical and why, you can build the assets assistants already look for and recover share from competitors.

Start with a focused prompt set, baseline your archetype, and fix the gaps that matter most—schema, entities, evidence, and local signals.

Measure inclusion, position, accuracy, and revenue by industry so you can prove impact and prioritize spend.

Use the playbooks and experiments here to keep improving.

If you want a partner to design, implement, and monitor industry-specific AISO programs, AISO Hub is ready to help.